National Preparedness Month: Flood Insurance

9/11/2018 (Permalink)

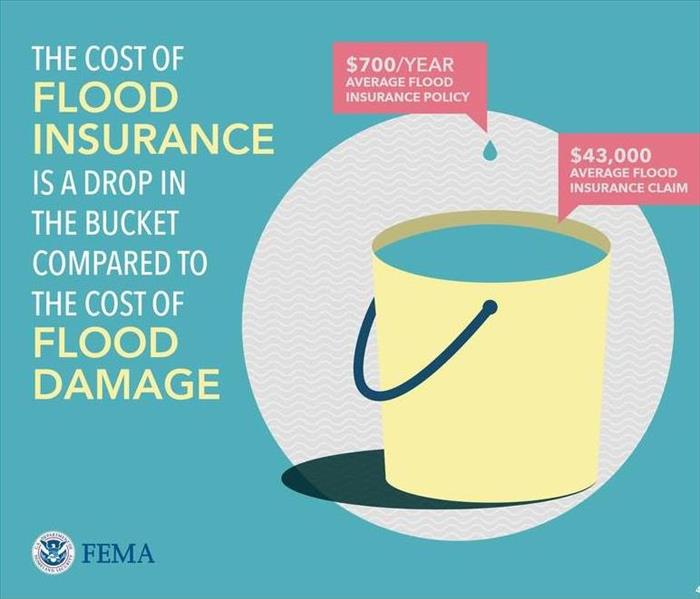

National Flood Insurance Program (NFIP) policies can be purchased through thousands of insurance agents nationwide. The agent who helps you with your homeowners or renters insurance may also be able to help you with purchasing flood insurance. Here is a list of participating Write Your Own (WYO) companies. If your insurance agent does not sell flood insurance, you can contact the NFIP Help Center at 800-427-4661. NFIP flood insurance policies can only be purchased for properties within communities that participate in the NFIP. Ask your agent if your community participates, or look it up online in the Community Status Book. No home is completely safe from potential flooding. Flood insurance can be the difference between recovering and being financially devastated. Just one inch of water in a home can cost more than $25,000 in damage—why risk it? Flooding can be an emotionally and financially devastating event. Without flood insurance, most residents have to pay out of pocket or take out loans to repair and replace damaged items. With flood insurance, you're able to recover faster and more fully. Use the tool below to see how much flood damage—even from just a few inches of water—could cost you. Do You Need Flood Insurance? Here are some important facts to keep in mind: The primary feature of flood maps are flood zones, which are geographic areas that FEMA has defined according to varying levels of flood risk and type of flooding. These zones are depicted on the published Flood Insurance Rate Map (FIRM) or Flood Hazard Boundary Map (FHBM). Everyone lives in an area with some risk of flood—it’s just a question of whether you live in a low-, moderate-, or high-risk area. To find your community’s flood map, visit the FEMA Flood Map Service Center, then type in your address and search. You may view, print and download flood maps, open an interactive flood map (if available), and view all products related to your community. Find out if your community has pending or preliminary map changes underway. When your community’s flood map is updated to reflect the current risks where you live, requirements for flood insurance coverage and the costs of your policy can also change. Want to receive an alert when your community’s flood map changes? Sign upto receive email notifications when products are updated. Get answers to your flood mapping questions online or by talking with someone from FEMA’s Flood Map Service Center. What you pay for flood insurance often has a lot to do with how much flood risk is associated with your building. Mitigation and other factors play a role in protecting properties from flood damage, but sometimes they can also help reduce how much you pay for your flood insurance policy. An elevated home, like the one shown in 5 Ways to Lower Your Flood Insurance Premium with a first floor elevated three feet above the Base Flood Elevation (BFE), can expect to save 60% or more on annual flood insurance premiums. If your community is enrolled in the Community Rating System (CRS), you may be receiving a discount on your flood insurance. The discount is calculated based on the community's efforts to reduce the risk of flooding. If you have questions about CRS, call your insurance agent or insurer. The Homeowner’s Guide to Retrofitting can help you decide the right method to mitigate future damage and loss by considering various factors, such as hazards to your home, permit requirements, technical limitations and costs. This guide also helps you develop a flood protection strategy. The Increased Cost of Compliance (ICC) coverage, for eligible properties that are required to be in compliance with local floodplain requirements, can help pay for elevating a building after a flood. Another way to get help with the cost of elevating your building would be through one of FEMA's various grant programs. The grants are administered by states, and each state decides which projects it will fund and for how much. Contact your local floodplain manager for more information. If you would like to consider elevating your home, learn more about it to determine if it might be a good option. It can be very expensive, but can substantially reduce flood damage and could be a way to reduce the cost of your flood insurance. Here’s another helpful resource: Chapter Five in Homeowner’s Guide to Retrofitting. Reducing Flood Risk to Residential Buildings that Cannot be Elevated explains things that can be done to better protect a building from flood damage, and in some cases implementing these changes will reduce the cost of your flood insurance. Source: Floodsmart.govThe Cost of Flooding

All About Flood MapsDid You Know?

Does my community get a discount?

Are there ways to protect my property from flood damage?

Elevation: is it the answer?

I cannot elevate my property, so what can I do?

24/7 Emergency Service

24/7 Emergency Service